Beyond the bomb: global exclusion of nuclear weapon producers

This report profiles 77 financial institutions that have in place a policy that restricts investments in nuclear weapon producers. This is an increase of 14 compared to the previous update of this report. Of these, 36 institutions have comprehensive policies in place. They are listed in the Hall of Fame. 41 institutions have a policy that is not all-inclusive. These are listed in the Runners-Up.

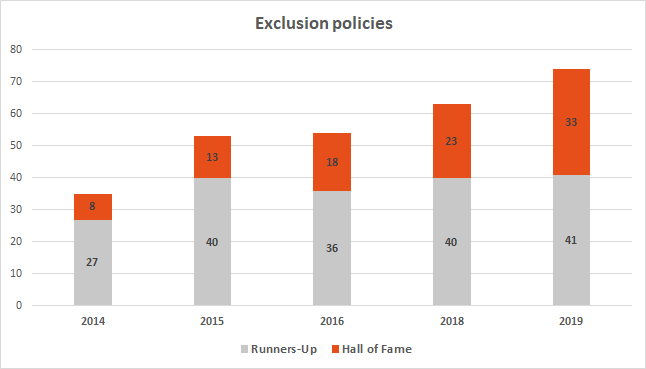

The number of financial institutions with public policies that specifically exclude nuclear weapons and other controversial weapons from investment continues to grow. The number of financial institutions listed in Don’t Bank on the Bomb’s Hall of Fame and Runners-Up has grown steadily from 35 in 2014 to 54 in 2016 (the year before the Treaty on the Prohibition of Nuclear Weapons was adopted) to 77 in this report. The growing numbers of financial institutions listed in this report provide a snapshot of what is becoming the new norm in the financial sector. In addition to the increase in identified policies, the application of these policies is becoming more comprehensive, illustrating financial institutional recognition of their role in not condoning the production of inhumane weapons.

Hall of Fame

The Hall of Fame profiles financial institutions that have adopted, implemented and published a policy that comprehensively prevents any financial involvement in nuclear weapon producing companies. 36 financial institutions have a public policy that is comprehensive in scope and application. The financial institutions in the Hall of Fame are based in Australia, Denmark, Germany, Italy, Luxembourg, the Netherlands, Norway, Sweden, Switzerland, the United Kingdom and the United States.

The total number of financial institutions in the Hall of Fame went from 23 in the 2018 report to 36 in this report. 9 financial institutions are completely new to the report:

- ABP (the Netherlands)

- Alternative Bank Schweiz (Switzerland)

- APG (the Netherlands)

- Bank Australia (Australia)

- Bank für Kirche und Caritas (Germany)

- bpfBOUW (the Netherlands)

- Ethos (Switzerland)

- Stichting Pensioenfonds voor de Woningcorporaties (the Netherlands)

- Zevin Asset Management (United States)

5 institutions have moved up from the Runners-Up. These institutions were moved up after an implementation check found they no longer have any financial relations with identified nuclear weapon producers.

- Andra AP-Fonden (AP2) (Sweden)

- DNB (Norway)

- Fjärde AP-Fonden (AP4) (Sweden)

- Första AP-Fonden (AP1) (Sweden)

- KLP (Norway)

Each institution’s policy profiled in the Hall of Fame undergoes a rigorous assessment. Only financial institutions with group level public policies are eligible for inclusion. Only when policies are applied to all types of nuclear weapon producers from all locations excluding them from all of the institutions’ financial services may an institution qualify for the Hall of Fame.

Investments are not neutral. Financing and investing are active choices, based on a clear assessment of a company and its plans. Financial institutions, by adopting public policies prohibiting investment in the nuclear weapons industry, actively demonstrate the stigma associated with these weapons of mass destruction. We hope the Hall of Fame will be inspirational to many more financial institutions.

Runners-Up

The Runners-Up section highlights another 41 financial institutions that have taken the step to exclude nuclear weapon producers from their investments, but whose policy is not all-inclusive in preventing all types of financial involvement with nuclear weapon companies. This is one more compared to the 40 institutions profiled last year. The financial institutions in the Runners-Up are based in Belgium, Canada, Denmark, France, Germany, Italy, Luxembourg, the Netherlands, New Zealand, Norway, Spain, Sweden, Switzerland, the United Kingdom and the United States.

2 institutions are completely new to the report: Domini (United States) and Deutsche Bank (Germany). One financial institution was moved from the Hall of Fame to the Runners-Up. Pension fund AP7 (Sweden) has a comprehensive policy that was listed in the Hall of Fame of previous reports. However, an implementation check found that they hold shares in one of the identified nuclear weapon producers.

The Runners-up category is necessarily broad. Financial institutions included range from those with policies nearly eligible for the Hall of Fame, to those with policies that still allow considerable sums of money to be invested in nuclear weapon producers. They are therefore ranked on a four-star scale to illustrate the comprehensiveness of their policies. One-star policies are included to demonstrate that there is a wide and ongoing debate among financial institutions when it comes to including nuclear weapons association criteria in their socially responsible investment standards. However diverse these policies, they all express a shared understanding that involvement in nuclear weapons production is controversial.

The identification of policies for inclusion in this report is based on peer recommendations. The report does not claim to represent an analysis of all financial institution policies on weapons, rather it provides a snapshot. Those in a position to recommend additional policies for inclusion are invited to do so. With a significant percentage of new wealth seeking investment in funds with strong environmental, social and governance criteria, along with the anticipated Entry Into Force of the Treaty on the Prohibition of Nuclear Weapons, it can be estimated that the number of policies excluding nuclear weapon producers will grow significantly over the coming years.

Runners-Up table

Imperfect policies| Financial Institution | Country of Origin | Excludes all producers | Excludes all activities | Applies policy to all financial products | No investments found |

|---|---|---|---|---|---|

| ABN Amro | Netherlands | v | $ | ||

| Achmea | Netherlands | v | v | v | |

| Aegon | Netherlands | v | $ | ||

| AMF | Sweden | v | |||

| Aviso Wealth | Canada | v | v | $ | |

| Azzad Asset Management | United States | v | v | v | |

| Barclays | United Kingdom | v | $ | ||

| BBVA | Spain | v | $ | ||

| BNP Paribas | France | v | $ | ||

| Commerzbank | Netherlands | v | $ | ||

| Crédit Agricole | France | v | $ | ||

| Credit Suisse | Switzerland | v | $ | ||

| Danske Bank | Denmark | v | |||

| Deutsche Bank | Germany | v | $ | ||

| Domini | US | v | |||

| Folksam | Sweden | v | v | v | |

| GPFG | Norway | v | v | v | |

| ING | Netherlands | v | $ | ||

| Intesa Sanpaolo | Italy | v | $ | ||

| KBC | Belgium | v | v | $ | |

| Länsförsäkringar | Sweden | v | v | $ | |

| New Zealand Superannuation Fund | New Zealand | v | $ | ||

| NN Group | Netherlands | v | $ | ||

| Nordea | Sweden | v | $ | ||

| Nykredit | Denmark | v | v | $ | |

| Pensioenfonds APF | Netherlands | v | v | v | |

| PGGM | Netherlands | v | v | v | |

| PKA | Denmark | v | v | v | |

| PME | Netherlands | v | v | v | |

| Rabobank | Netherlands | v | v | v | |

| Royal Bank of Canada | Canada | v | $ | ||

| Royal Bank of Scotland | United Kingdom | $ | |||

| SEB | Sweden | v | v | $ | |

| Sjunde AP-fonden AP7 | Sweden | v | v | v | $ |

| Sparinvest | Luxembourg | v | v | $ | |

| Standard Chartered | United Kingdom | v | v | $ | |

| Swedbank | Sweden | v | v | $ | |

| Tredje AP-Fonden AP3 | Sweden | v | v | $ | |

| Unicredit | Italy | v | $ | ||

| Van Lanschot Kempen | Netherlands | v | v | v | |

| VDK Bank | Belgium | v | v |