Hall of Shame

Download the full Hall of Shame here

In total, more than USD 525 billion was made available to the nuclear weapon producing companies by the investors listed. These investors assisted with share and bond issuances, owned or managed shares and bonds or outstanding loans or made credit facilities available to nuclear weapon producing companies between January 2014 and October 2017. The research includes all outstanding loans and credit facilities during the research period, not only new loans issued.

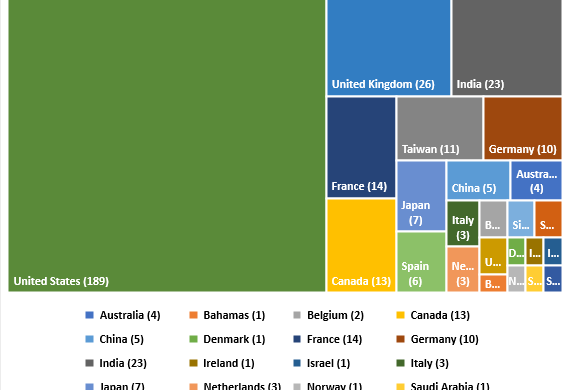

This section shows how much money each of the 329 financial institutions made available to the 20 listed nuclear weapon producers. Financial institutions may include banks, pension funds, insurance companies or asset managers. Of the 329 financial institutions listed, 189, or 57% of them are from the United States and invest more than $375 billion.

Financial institutions can be involved in financing companies by providing corporate loans, by assisting companies with share- and bond issues, and by (managing) investments in shares and bonds of these companies. For asset managers and pension funds, the only relevant type of financial involvement is (managing) share- and bond holdings of the selected companies.

What’s included?

The summary table shows how much money, in millions of US Dollars each of the listed financial institution made available to the 20 listed nuclear weapon producing companies between January 2014 and October 2017.

It does not list the types of financing, though that information is available upon request. The types of financing could include loans (including revolving credit facilities), investment banking (including underwriting share and bond issuances), and ownership of at least 0.5% of the outstanding shares or bonds of at least one of the companies.

Changes from previous reports

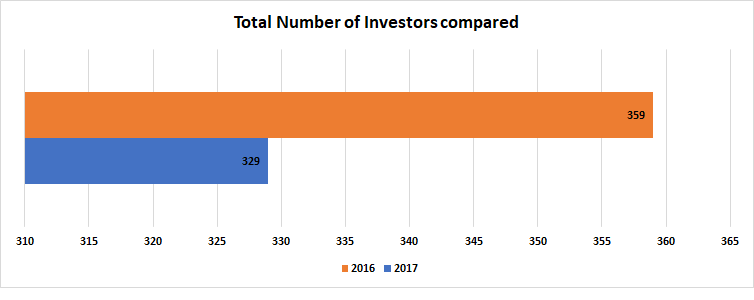

The previous Don’t Bank on the Bomb report identified 359 investors in the identified nuclear weapon producers. Of the institutions identified in this report, 264 financial institutions have been identified previously, while 65 are new investors. 95 of the financial institutions identified in the previous report were no longer found to have investments. Some of these changes may be due to name changes of the financial institutions, or changes in the parent- subsidiary relationships.

Newly identified investors come from the Bahamas, Belgium, China, France, Germany, India, Ireland, Italy, Norway, Spain, the United Kingdom and the United States and represent around $18 billion in investments.

Investors not returning to the report come from Bahrain, Canada, Germany, India, Japan, Jordan, Kuwait, Norway, Singapore, Spain, Switzerland, the United Kingdom and the United States.

Methodology

Methodology

Which financial institutions are involved in the financing of the selected nuclear weapon companies was researched in annual reports, stock exchange filings and other publications of the companies concerned, archives of trade magazines, local newspapers and the financial press as well as specialized financial databases (Thomson ONE, Bloomberg). We found 329 financial institutions that meet these criteria.

This report includes information about all loans outstanding during the research period, not just new loans provided. This provides a fuller picture of the overall investments in nuclear weapons producing companies. Therefore, also included in the current study are loans and credit facilities of which the closing date lies before January 2014, but that have not matured yet at the time of writing (October 2017). In at least one known case this leads to the inclusion of one tranche of a credit facility while the other tranche is excluded. The USD 4.6 billion revolving credit facility issued by Boeing on 5 November 2011 had a USD 2.3 billion tranche with maturity date on 8 November 2012 and a USD 2.3 billion tranche with maturity date on 10 November 2016. Only the latter has been included.

Download the full Hall of Shame here

Financial institutions per country per year:

| 2018 | 2016 | 2015 | |

| Australia | 4 | 4 | 5 |

| Austria | 1 | ||

| Bahamas | 1 | ||

| Bahrain | 1 | ||

| Belgium | 2 | 1 | 2 |

| Canada | 13 | 18 | 17 |

| China | 5 | 4 | 5 |

| Denmark | 1 | 1 | 1 |

| France | 14 | 9 | 11 |

| Germany | 10 | 10 | 9 |

| India | 23 | 23 | 22 |

| Indonesia | 1 | ||

| Ireland | 1 | 0 | |

| Israel | 1 | 1 | 1 |

| Italy | 3 | 2 | 2 |

| Japan | 7 | 8 | 8 |

| Jordan | 1 | ||

| Kuwait | 1 | ||

| Netherlands | 3 | 3 | 3 |

| Norway | 1 | 1 | 2 |

| Saudi Arabia | 1 | 1 | 1 |

| Singapore | 2 | 3 | 3 |

| South Africa | 1 | ||

| Spain | 6 | 5 | 4 |

| Sweden | 1 | 1 | 2 |

| Switzerland | 2 | 5 | 4 |

| Taiwan | 11 | 11 | 11 |

| UAE | 2 | 2 | 2 |

| United Kingdom | 26 | 32 | 26 |

| United States | 189 | 210 | 201 |

| Total number of Financial Institutions | 329 | 359 | 347 |