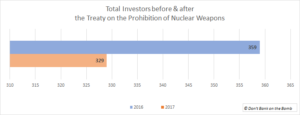

329 significant investors

From January 2014 through October 2017, our research found 329 banks, insurance companies, pension funds and asset managers from 24 countries that invest significantly in the top 20 nuclear weapon producers. Of these, 204 are based in North America, 70 are based in Europe, 52 are based in Asia- Pacific, 3 in the Middle East, and none are based in Africa or Latin America. All financial institutions are identified at the group level, though many operate subsidiaries in other regions. The total number of investors is 30 fewer than the previous report.

From January 2014 through October 2017, our research found 329 banks, insurance companies, pension funds and asset managers from 24 countries that invest significantly in the top 20 nuclear weapon producers. Of these, 204 are based in North America, 70 are based in Europe, 52 are based in Asia- Pacific, 3 in the Middle East, and none are based in Africa or Latin America. All financial institutions are identified at the group level, though many operate subsidiaries in other regions. The total number of investors is 30 fewer than the previous report.

20 nuclear weapon producing companies

Don’t Bank on the Bomb 2018 profiles the top 20 companies involved in the production of key components for the nuclear arsenals of France, India, the United Kingdom and the United States. The list of companies is not exhaustive. It is an attempt to identify the privately owned companies that are most heavily involved in the nuclear weapon industrial complex. There remain other companies involved on a different scale or more indirectly. The companies described here are based in France, India, the Netherlands, the United Kingdom and the United States. One producer, CH2M Hill (United States) was acquired in December 2017 by Jacobs Engineering however, we have retained their profile and investment information as the acquisition took place after the close of our financial research period (January 2014- October 2017).

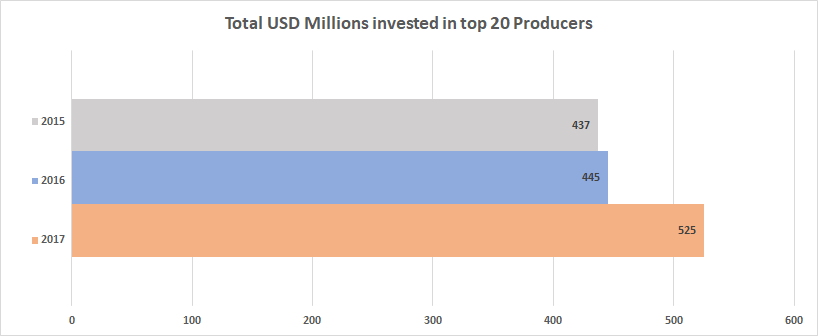

$525 billion invested

$525 billion invested

In total, more than USD 525 billion was made available to the nuclear weapon producing companies by the investors listed. These investors assisted with share and bond issuances, owned or managed shares and bonds or outstanding loans or made credit facilities available to nuclear weapon producing companies between January 2014 and October 2017. The research includes all outstanding loans and credit facilities during the research period, not only new loans issued.

The top 10 investors alone provided more than USD 253 billion to the identified nuclear weapon producers, nearly half of the total investment. All of the top 10 are based in the US. The top 3: Blackrock, Capital Group, and Vanguard, have a combined investment of more than $110 billion.

In Europe, the most heavily invested are BNP Paribas (France), Crédit Agricole (France) and Barclays (United Kingdom) with combined investments over $24 billion.

In the Asia-Pacific region, the biggest investors are Mitsubishi UFJ Financial, Mizuho Financial, and Life Insurance Corporation of India (India) with a combined investment of over $17 billion.

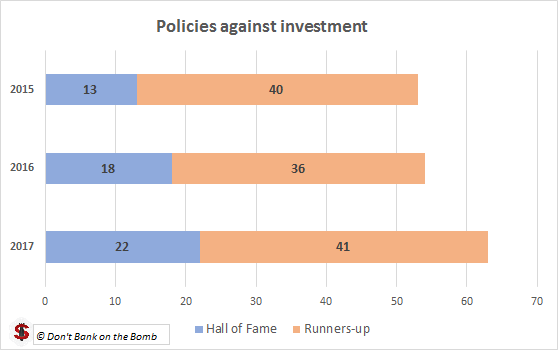

22 Positive examples: The Hall of Fame

22 Positive examples: The Hall of Fame

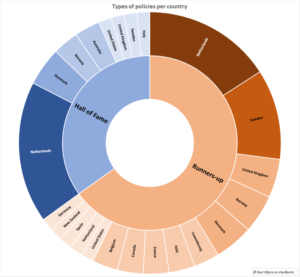

Don’t Bank on the Bomb 2018 also profiles financial institutions that have adopted, implemented and published a policy that comprehensively prevents any financial involvement in nuclear weapon producing companies. 22 financial institutions have a public policy that is comprehensive in scope and application, four more than listed in the 2016 report. These are identified in the Hall of Fame. The financial institutions in the Hall of Fame are based in Australia, Denmark, Italy, the Netherlands, Norway, Sweden, the United Kingdom and the United States.

Investments are not neutral. Financing and investing are active choices, based on a clear assessment of a company and its plans. Financial institutions, by adopting public policies prohibiting investment in the nuclear weapons industry, actively demonstrate the stigma associated with these weapons of mass destruction. These financial institutions are clearly in compliance with all provisions of the Treaty on the Prohibition of Nuclear Weapons.

41 Imperfect exclusions: Runners-up

Don’t Bank on the Bomb highlights another 41 financial institutions that have taken the step to exclude nuclear weapon producers from their investments, but whose policy is not all-inclusive in preventing all types of financial involvement with nuclear weapon companies.

The Runners-up category is necessarily broad. Financial institutions included range from those with policies nearly eligible for the Hall of Fame, to those with policies that still allow considerable sums of money to be invested in nuclear weapon producers, they are therefore ranked to illustrate the comprehensiveness of their policies. Even the no star policies are included to demonstrate that there is a wide and ongoing debate among financial institutions when it comes to including nuclear weapons association criteria in their socially responsible investment standards. However diverse these policies, they all express a shared understanding that involvement in nuclear weapons production is at least controversial.